See This Report on Bank Statement

Wiki Article

The Main Principles Of Banking

Table of ContentsMore About Bank StatementThe Buzz on Bank Draft MeaningSome Ideas on Bank Draft Meaning You Need To KnowNot known Details About Bank Account Little Known Questions About Bank.

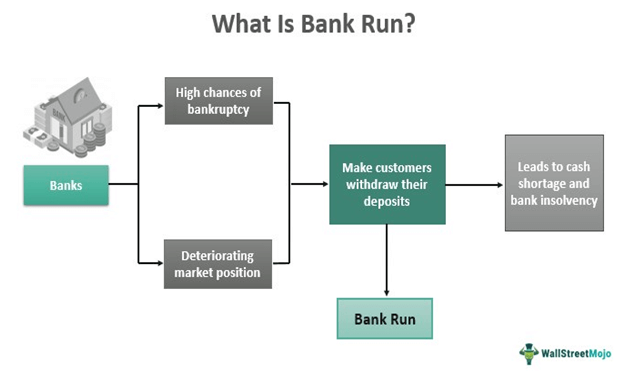

When a bank is perceivedrightly or wronglyto have issues, consumers, fearing that they might shed their down payments, might withdraw their funds so fast that the small section of liquid possessions a financial institution holds becomes swiftly tired. Throughout such a "run on down payments" a financial institution may have to sell other longer-term and much less fluid properties, frequently muddle-headed, to meet the withdrawal needs.

Regulators have broad powers to intervene in struggling banks to minimize disturbances. Rules are usually created to limit banks' direct exposures to credit report, market, and also liquidity dangers and also to general solvency threat (see "Shielding the Whole" in this issue of F&D). Banks are now called for to hold even more and higher-quality equityfor example, in the form of preserved incomes and also paid-in capitalto barrier losses than they were before the monetary crisis.

Not known Incorrect Statements About Bank Draft Meaning

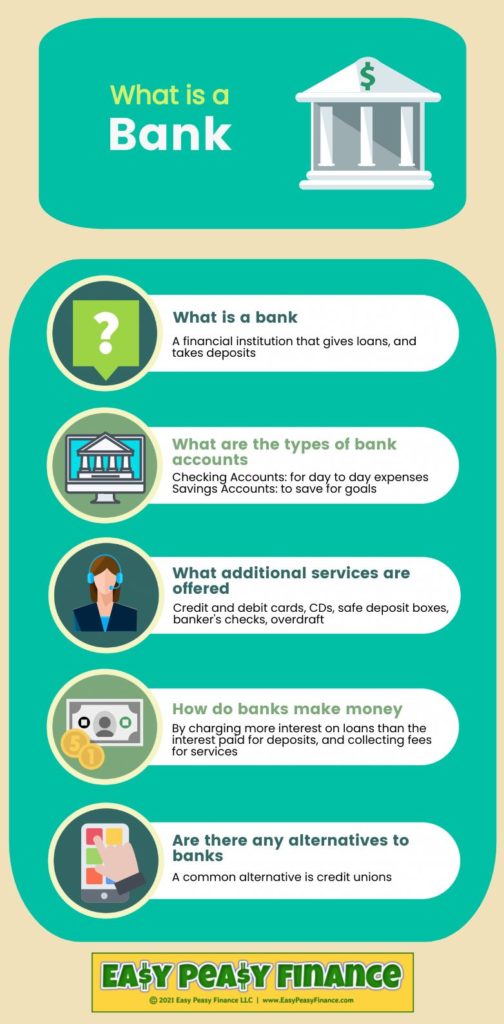

A bank is a monetary organization licensed to offer solution alternatives for consumers that want to save, obtain or accumulate more cash. Banks usually approve deposits from, and also offer financings to, their customers. Can help you obtain funds without a financial institution checking account.While banks may supply similar economic solutions as credit rating unions, financial institutions are for-profit organizations that direct many of their monetary returns to their investors. That implies that they are less most likely to provide you the ideal possible terms on a finance or a cost savings account.

Those borrowers then pay the lending back to the financial institution, with passion, over a set time (bank account number). As the borrowers repay their loans, the bank pays a fraction of the paid passion to its account holders for enabling it to utilize the deposited cash for released finances. To further your individual as well as business interests, banks offer a large variety of economic services, each with its own positives and downsides depending upon what your cash motivations are and just how they could progress.

The Only Guide to Bank

Financial institutions are not one-size-fits-all procedures. Various types of consumers will find that some banks are much better monetary companions for their goals and requirements than others.The Federal Reserve controls other banks based in the united state, although it is not the only government agency that does so. Area banks have less possessions due to the fact that they are unconnected to a major national financial institution, yet they provide monetary solutions throughout a smaller geographic impact, like an area or region.

On-line banks do not have physical areas however tend to provide far better passion prices on car loans or accounts than banks with physical areas. Transactions with these online-only establishments normally happen over a web site or mobile app and click here for info also hence are best for a person who does not need in-person help and fits with doing most of their financial electronically.

The Bank Reconciliation Statements

(C) U.S. Bancorp (USB) Unless you prepare to stash your money under your bed mattress, you will at some point require to engage with a banks that can safeguard your money or problem you a car loan. While a financial institution may not be the institution you ultimately select for your monetary needs, comprehending how they operate as well as the services they can provide can assist you determine what to search for when making your selection.Bigger banks will likely have a bunch of brick-and-mortar branches and also ATMs in practical locations, along with numerous digital banking offerings. What's the distinction in between a financial institution and a lending institution? Due to the fact that financial institutions are for-profit institutions, they tend to use much less appealing terms for their consumers than a credit rating union might provide to take full advantage of returns for their investors.

a lengthy raised mass, esp of earth; pile; ridgea incline, as of a hillthe sloping side of any type of hollow in the ground, esp when surrounding a riverthe left financial institution of a river gets on a viewer's left looking downstream a raised area, rising to near the surface area, of the bed of a sea, lake, or river (in mix) sandbank; mudbank the area around the mouth of the shaft of a mine the go to this web-site face of a body of visite site orethe side disposition of an airplane about its longitudinal axis throughout a turn, Likewise called: financial, camber, cant, superelevation a bend on a road or on a train, sports, biking, or various other track having actually the outside built greater than the inside in order to minimize the impacts of centrifugal force on automobiles, runners, etc, rounding it at rate as well as in some instances to facilitate drainagethe cushion of a billiard table. bank certificate.

Not known Factual Statements About Bank Statement

You'll need to provide a financial institution statement when you apply for a financing, documents tax obligations, or documents for divorce. A financial institution declaration is a document that summarizes your account task over a certain period of time.

Report this wiki page